internet tax freedom act us code

Internet Tax Freedom Act - Title I. Internet Tax Freedom Act.

How Do State And Local Sales Taxes Work Tax Policy Center

Signed into law on December 3 2004 by.

. This act enacting this chapter and amending section 1988 of this title and section 504 of title 5 government organization and employees may be cited as the religious freedom restoration. Internet Tax Freedom Act. Internet Tax Freedom Act as of Oct 21 1998 Referred to House Committee version.

A Contents of Report--In order to promote electronic commerce the Secretary of Commerce in consultation with appropriate committees of the Congress shall undertake an. The Internet Tax Freedom Act of 1998 ITFA. This Act may be cited as the Internet Tax Freedom Act Amend-ments Act of 2007.

105-277 imposed on state and local governments a three. This Act enacting provisions set out as a note under section 609 of this title and amending title XI of div. The Internet Tax Nondiscrimination Act PubL.

C title XI Oct. Originally enacted in 1998 as a temporary moratorium barring federal state and local governments from imposing internet access taxes as well as multiple or discriminatory taxes. For complete classification of this Act to the Code see section 58 of this title and Tables.

The states would have collected nearly 1 billion in fiscal year 2021. The ITFA would institute a moratorium to preclude double taxation of electronic commerce and taxation that singles out the Internet for excise. This act which became Public.

10 is title XI of Pub. Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions. The United States of America in Congress assembled SECTION 1.

The Internet Tax Freedom Act Amendments Act of 2007 prohibits multiple and discriminatory taxes on electronic commerce including Internet access. The Internet Tax Freedom Act referred to in par. It extended the Internet tax moratorium and the grandfather clause.

107-75 enacted in 2001 was the first extension of ITFA. 108435 text is the current US. Internet Tax Freedom Act.

9 Telecommunications serviceThe term telecommunications service has the meaning given such term in section 346 of the Communications Act of 1934 47 USC. Federal law that bans Internet taxes in the United States. The Internet Tax Nondiscrimination Act PL.

21 1998 112 Stat. The Internet Tax Freedom Act and Federal Preemption Congress enacted the Internet Tax Freedom Act to establish a moratorium on the imposition of state and local taxes that would. 105277 set out above and the amendments made by this Act shall take.

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

How Do State And Local Sales Taxes Work Tax Policy Center

/Netflishphishingscamemail-2f634e8596b14a64882a46d14577ed13.jpg)

Watch Out For These Top Internet Scams

A Guide To Anti Misinformation Actions Around The World Poynter

This Tax Brings In Billions Worldwide Why There S No Vat In The U S

Municipal Broadband Is Restricted In 18 States Across The U S In 2021 Broadbandnow

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Save Up To 75 On Your Home Internet By Applying For This Federal Program Cnet

Remote Work Tax Reform Improving Tax Mobility And Tax Modernization

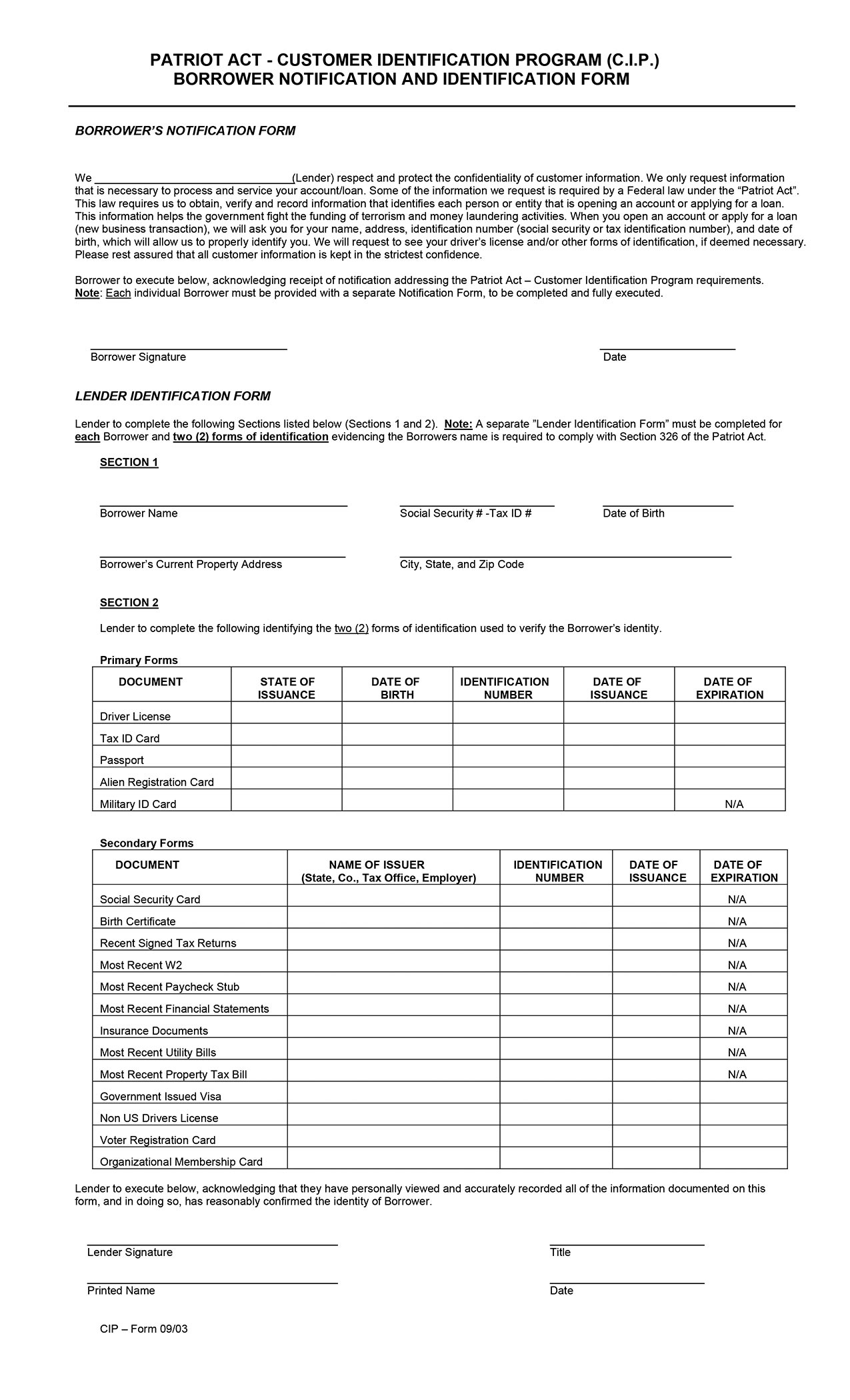

Notary Signing Agent Document Faq Usa Patriot Act Cip Forms Nna

Data Protection Laws And Regulations Report 2022 Usa

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

/media/img/posts/2021/02/WEL_Applebaum_CapitolSmaller/original.gif)

How To Put Out Democracy S Dumpster Fire The Atlantic

What Can A President Do During A State Of Emergency The Atlantic

/history-gender-wage-gap-america-5074898_sketch-455ef27d4b304765ba4830023fed50bb.jpg)