interest tax shield calculator

A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. Here we discuss how to calculate depreciation and interest tax shield for the company along with the practical examples and downloadable excel sheet.

Tax Shield Formula Step By Step Calculation With Examples

For example there are some cases where mortgages have an interest tax shield for the buyers as the mortgage interest is deductible on the income.

. Simpleaccounting rate of return ARR calculator. Interest Tax Shield Interest Expense Tax Rate. These are the tax benefits derived from the creative structuring of a financial arrangement.

Basically the company uses two main tax shield strategies. So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement. Tax shields are favored by wealthy individuals and corporations but middle-class individuals can benefit from tax shields as well.

Its 50000 debt load has an interest tax shield of 15000 or 50000. Lets understand this with the help of an example of a convertible bond. An investor can use Excel to build out a model to calculate the net present value of the firm and the present.

A companys interest payments are tax deductible. Else this figure would be less by 2400 800030 tax rate as only depreciation would. For individuals Tax rate is primarily used for interest expense and depreciation expense in the case of a company.

In such a case one needs to add back the after-tax interest expense to the income. Net present value calculator. The value of the interest tax shield is the present value ie PV of all future interest tax shields.

How to calculate the tax shield. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. The Interest Tax Shield concept is highly relevant for Leveraged Buyout LBO acquisitions executed by Private Equity firms.

To calculate your tax shield first find the total cost of the deduction for the entire year then multiply that cost by your estimated tax rate. This has been a guide to Tax Shield Formula. If you have 1000 in interest expense for the year with a 35 percent tax rate your tax shield would be 350.

If you like Interest Tax Shield Calculator please consider adding a link to this tool by copypaste the following code. That is the interest expense paid by a company can be subject to tax deductions. Ad TaxInterest is the standard that helps you calculate the correct amounts.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate. A formula to calculate after-tax interest expense is interest expense 1.

Examples of tax shields include deductions for charitable contributions mortgage deductions medical expenses and depreciation. This gives you a good idea of the tax shield on that item. After-tax benefit or cash inflow calculator.

Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. And this net effect is the loss of the tax shield value but again of the original expense as income.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable.

Since the additional financing benefits are taken into account the primary benefit of the APV approach is that the economic benefits stemming from financing and tax-deductible interest expense payments eg. The tax rate for the company is 30. Common expenses that are deductible include depreciation amortization mortgage payments and interest expense.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution medical expenditure etc. This step by step finance tool is used for calculating the interest tax shield. Future value of an annuity calculator.

Depreciation tax shield calculator. The value of these shields depends on the effective tax rate for the corporation or individual. The interest tax shield are broken out.

This is equivalent to the 800000 interest expense multiplied by 35. As such the shield is 8000000 x 10 x 35 280000. The tax shield on interest is positive when earnings before interest and taxes ie EBIT exceed the interest payment.

The impact of adding removing a tax shield is highly impacted by the companys optimal capital structure which is a mix of debt and equity fundingMoreover the interest expense on the debt is tax deductible which makes the. For example if a company has cash inflows of USD 20 million cash outflows of USD 12 million its net cash flows before taxation work out to USD 8 million. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

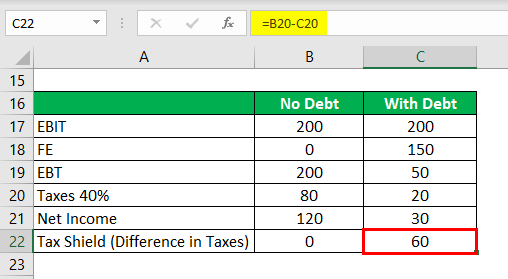

This small business tool is used to derive the interest tax using the average debt tax rate and cost of debt. Interest Tax Shield Calculator. The Interest Tax Shield is the same as the Depreciation Tax Shield in concept.

In contrast though with the Interest Tax Shield it is Interest Expense that shields a Company from taxes paid. Easily Project and Verify IRS and State Interest Federal Penalty Calculations. A tax shield refers to deductions taxpayers can take to lower their taxable income.

The formula used to calculate the adjusted present value APV consists of two components. Such a deductibility in tax is known as interest tax shield. Adjusted Present Value APV Formula.

Taxes Icon Business Calculator Ticket Payment Taxes Commerce And Shopping Business And Finance Tax Icon Law And Justice Free Icons

Tax Shield Formula Step By Step Calculation With Examples

Trulia Mortgage Center Goes Live Agbeat Mortgage Amortization Calculator Mortgage Loans Mortgage

Tax Shield Calculator Efinancemanagement

Accounting And Finance Expert Calculate Budget Profit And Loss Produce Report Graph From Data Professional Conc In 2022 Accounting And Finance Budgeting Accounting

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tomorrows Planning Is Todays Tax Saving Invest Save Tax Earn Interest With Synd Taxshield Deposit Syndicatebank Deposit Linkedin Photo Award Winner

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Wacc Formula Cost Of Capital Financial Management Charts And Graphs